An official from state oil firm Nigerian National Petroleum Corp.

said Friday to Platts that production has fallen by 50% since the start of the year.

As we have said many times in our daily reports, the situation in Nigeria will only worsen going forward. NDA does not sound like they are joking around as another operation to destroy Nigeria's oil infrastructure continues. So far, the Nigerian government has not responded with the same force NDA has exerted on the fragile oil industry. As NDA continue their operation of terrorizing the oil companies, questions might pop up, such as the stability of the nation's oil production. Chevron (NYSE:

CVX), the victim of the last two events, could seriously question whether its presence in Nigeria makes sense if the government does not seek to protect its interest.

It seems to us that the Nigerian government is set on eradicating corruption, which is extremely bullish for the long run. But the long term is dictated by a continuation of short-term events, and we do not see the light at the end of the tunnel for Nigeria within the next two years. As oil prices hover around $50, Nigeria's ability to even consider paying NDA is out of the question. Even if the government does decide to give NDA lucrative security contracts, we suspect the price is far too low to even consider.

What will this mean for the future of Nigeria's oil production?

We don't know, but in the short run, it seems to us that the attacks will continue. As oil infrastructure damages create delays in ramping production back up, we fear that it's the safety of the situation in Nigeria that will force international oil companies to declareforce majeure. If this happens, you should expect to see crude exports in Nigeria to fall off a cliff.

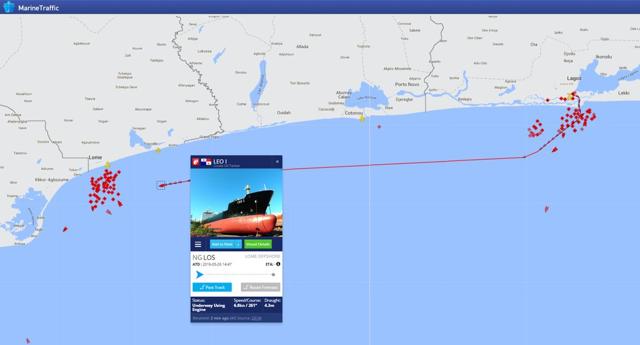

According to

Samir Madani, tankers picking up crude in Nigeria are having a hard time filling up the tanks and are being rerouted to Togo instead.

(click to enlarge)

How soon will this be felt via storage numbers? We will start to see it in the inventory reports soon enough.

NDA Warns of One Big Threat

(click to enlarge)

NDA is now going to leave the world wondering as to what the next attack will be. This is especially ominous as the OPEC meeting is next week, and Nigeria's oil infrastructure safety will be a topic. Just what will NDA do to Nigeria's already fragile oil infrastructure?

Baker Hughes Rig Count

Rig counts were unchanged this week, with oil drilling rigs falling by two and natural gas rigs going up by two. We don't think rig counts will change much heading into the end of the year. We might see some rigs coming back online, but we expect that number to be less than 50. This is far lower than what's needed to keep production flat.

We hope you have enjoyed our oil (NYSEARCA:

USO) markets daily. Please click on the follow button above and read our other energy write-ups. In addition, we also have a

premium subscription platform that's tailored to long-term value-oriented investors. We provide recommendations of stock ideas and portfolio composition. Our HFI portfolio has

now outperformed the SPY by 10% since inception. We look forward to you joining the HFI platform.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Sour

We appreciate you for visiting naijafingers, but we think it will be better you like our facebook fanpage and also follow us on twitter below.